Banks often charge monthly fees just to maintain your checking account. Some financial institutions will charge penalty fees if you dip below the required minimum balance, or hit your account with an annoying fee for accessing ATMs at competing banks. But that doesn't mean it's impossible to sign up for a free checking account that can save you a few bucks.

Popular Searches

Ally Bank offers a free, interest-bearing checking account without a minimum opening deposit. Other features include the following: No monthly maintenance fees 0.10% APY on accounts with a minimum daily balance under $15,000. Bank: A bonus of $100, $200 or $400 for new checking accounts with at least two recurring direct deposits that total minimums of, respectively, $1,000, $2,000 or $4,000 within 60 days,. Ally Bank offers a checking account that doesn’t have a monthly maintenance fee or a minimum opening deposit. It also offers a little interest, 0.1 percent APY on balances less than $15,000. May 20, 2020 Best Free Checking Accounts of 2020 — Individual Reviews. As you might guess, many banks with free checking are online banks, which have lower costs than traditional brick-and-mortar banks. Totally free checking accounts are fairly standard in terms of the amenities offered, but a few offer some surprising features. Ally Bank Interest Checking.

With a number of free checking accounts to choose from, it's a no-brainer to find a no-fee option. Here's a look at what banks offer free checking accounts.

1. Ally: Interest Checking Account

Ally Bank offers an Interest Checking account with no minimum deposit to open or monthly maintenance fee. And even though it's not much, it offers 0.10 percent APY on balances under $15,000 and 0.25 percent APY for those who carry a daily balance of $15,000 or more.

Interest Checking account also offers perks, such as free standard checks and access to Allpoint ATMs, plus great mobile app ratings.

- Minimum deposit and balance requirements: $0

- Yield: up to 0.25 percent APY ($15,000 minimum daily balance required for this APY, otherwise 0.10 percent APY)

- Physical branch: No

- Mobile app offered: Yes; Apple’s App Store rating 4.7 stars. Google Play Store rating 4.0 stars.

- ATM access: 55,000 Allpoint surcharge-fee ATMs, plus up to $10 per statement reimbursement for fees charged at other ATMs in the U.S.

- Offers and incentives: Free standard checks, no-fee cashier's checks and incoming wire transfers, and free access to Allpoint ATMs.

Keep in mind that Ally does not have any physical branches for you to visit if you have a concern that requires in-person assistance.

2. Capital One: 360 Checking Account

Capital One charges no fees to open or use a 360 Checking account, not even for foreign country debit card transactions, and mobile banking is streamlined and easy to use.

- Minimum deposit and balance requirements: $0

- Yield: 0.10 percent APY

- Physical branch: Yes

- Mobile app offered: Yes; Apple ‘s App Store rating: 4.8 stars. Google Play Store rating: 4.7 stars.

- ATM access: 40,000 Capital One and Allpoint ATMs

Know that there may be some things you want or need to do with your account, like overnight check delivery or stop payments, that will result in charges.

3. Heritage Bank: eCentive Account

Midwest-based Heritage Bank perhaps doesn't come with the cache or brand recognition of the big banks. But its generous APY for its free checking account is a big draw if you're able to meet a few requirements:

The APY of 1.32 percent on qualifying balances up to $25,000 is very attractive.

However, if you carry a balance over that amount, you'll receive an APY that's a full percentage point lower. Also, to qualify for the higher APY on balances under $25,000, you have to make 10 or more debit card payments or purchases every month, have at least one monthly direct deposit or automatic payment (ACH), and sign up for paperless statements. If you can live with all of that, this is a great high-yield account for you. Note that the bank will charge a $30 fee if you close this account within six months of opening.

- Minimum deposit and balance requirements: $100 to open; no minimum balance

- Yield: 1.32 percent on account balances up to $25,000

- Physical branch: Yes, in Minnesota, Iowa and South Dakota

- Mobile app offered: Yes; Apple’s App Store rating 4.8. Google Play Store rating: 4.6.

- ATM access: Yes, in Minnesota, Iowa and South Dakota

4. Simple: High-Interest Online Checking Account

Simple aims to make banking easy. When you open a Simple high-interest online checking account, you'll earn a 0.80 percent APY with no opening amount due and no monthly balance requirements. You'll also get access to a Simple Visa debit card to swipe anywhere Visa is accepted, and you'll have easy access to send money instantly to other Simple customers.

The account also interfaces well with Zelle, PayPal, Venmo, and other payment platforms. Plus the built-in budget tracker keeps all your expenses in check.

- Minimum deposit and balance requirements: $0

- Yield: 0.80% APY

- Physical branch: No.

- Mobile app offered: Yes; Apple’s App Store rating 4.5. Google Play Store rating 4.2.

- ATM access: more than 40,000 Allpoint ATMs

5. NBKC: Everything Account

Based in the Kansas City, Missouri, metro area, NBKC Bank offers easy banking services. The bank's Everything Account yields 0.80 percent. NBKC Bank charges no minimum balance fees, overdraft fees, maintenance fees, or fees on returned items, stop payments, cashier’s checks and other services. Plus, the bank will reimburse up to $12 a month for other banks' ATM fees.

- Minimum deposit: $5

- Balance requirement: $0.01 to earn interest

- Yield: 0.80% APY

- Physical branch: Yes

- Mobile app offered: Yes: Apple’s App Store rating 3.8. Google Play Store rating 4.0.

- ATM access: 32,000 MoneyPass ATMs

Note that wire transfers coming in are free, but if you need to send one, the bank will charge you $5.

Bottom line

There's no point to pay for a checking account, when a number of banks offer free checking. But while free checking is good, it only works if your banking needs are met. Before you choose a checking account, consider whether you need access to ATMs, paper checks, in-person branches or 24/7 account information? Plenty of banks offer perks and even earned interest on their free checking accounts - just make sure you pay attention to the fine print.

Learn more:

No minimum balance. Pure

and simple.

Low monthly maintenance fee

just $5.99 with no minimum balance

On-the-go banking

with every TD Bank checking account

Which Banks Offer Free Checking Accounts

Banking simplified

- No minimum balance

- Low, predictable monthly maintenance fee of just $5.99

Legendary convenience

- Free access at thousands of TD ATMs in the U.S. and Canada

- TD Bank Visa® Debit Card available on-the-spot

- Open early. Open late. Most locations open 7 days

Save money

- Discount on your first order of checks

- Rate discounts on TD Bank home loans – .25% off home equity line of credit1

On-the-go banking

- Free Mobile Banking with Mobile Deposit2

- Online Banking and free Bill Pay with e-bills

- Free online statements with check images

- Live Customer Service 24/7

Checkouts just got easier.

Pay with your TD Bank Debit Card

- In person

- Online or over the phone

- In apps or app stores

- Using your digital wallet

Open an account

Apply online

minutes or less.

Call us

Apply in person

1Loans subject to credit approval. Relationship discount may be terminated and the interest rate may increase upon closure of the qualifying personal checking account.

2TD Bank Mobile Deposit is available to Customers with an active checking, savings or money market account and using a supported, internet-enabled iOS or Android device with a camera. Other restrictions may apply. Please refer to the Mobile Deposit Addendum.

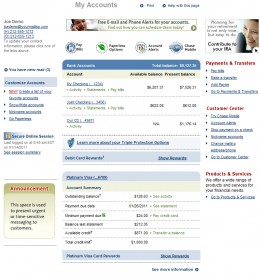

Compare | CheckingSM | |||||

|---|---|---|---|---|---|---|

| Monthly maintenance fee | with a minimum daily balance of $100 —OR— $15 | with a minimum daily balance of $2,500 —OR— $25 | with a $20,000 minimum combined deposit, outstanding loan and/or mortgage balance (excludes credit card) —OR— $25 | with a minimum daily balance of $250 —OR— $10 | ||

| Earns interest | ||||||

| Checks | ||||||

| Online statements | ||||||

| Paper statements | (Paper statements are optional for Online Banking customers) | (Paper statements are optional for Online Banking customers) | (Paper statements are optional for Online Banking customers) | |||

| ATM fees | Other banks' ATM fees reimbursed with a minimum daily balance of $2,5001 | Other banks' ATM fees reimbursed with a minimum daily balance of $2,5001 | ||||

| Overdraft protection | ||||||

| Free with this account | Official bank checks Stop payments Incoming wire transfers | Official bank checks Stop payments Incoming wire transfers No monthly maintenance fee on savings accounts and one additional checking account | Official bank checks |

Free Mobile Banking with Mobile Deposit3

Online Banking and free Bill Pay with e-bills

TD Bank Debit Card available on-the-spot

Live Customer Service 24/7

Free access at thousands of TD ATMs in the U.S. and Canada

Flexible ways to Send Money via text or e-mail and make internal and external transfers3

Free online statements with check images

Rate discounts on TD Bank home loans - .25% off home equity line of credit4

Choice of overdraft services available

Open early. Open late. Most locations open 7 days

Alternate format statements available, learn more about TD Bank accessibility options.

Checkouts just got easier.

Pay with your TD Bank Debit Card

- In person

- Online or over the phone

- In apps or app stores

- Using your digital wallet

Open an account

Apply online

minutes or less.

Call us

help you over the phone.

Apply in person

1Non-TD fees reimbursed when minimum daily balance is at least $2,500 in checking account. For non-TD ATM transactions, the institution that owns the terminal (or the network) may assess a fee (surcharge) at the time of your transaction, including balance inquiries.

2TD Bank Mobile Deposit is available to Customers with an active checking, savings or money market account and using a supported, internet-enabled iOS or Android device with a camera. Other restrictions may apply. Please refer to the Mobile Deposit Addendum.

3Send Money is available for most personal checking and money market accounts. External transfer services are available for most personal checking, money market and savings accounts. To use either of these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address, and a Social Security Number. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To perform instant transfers a TD Bank Visa® Debit Card is required. Fees may apply depending on delivery options.

4Loans subject to credit approval. Relationship discount may be terminated and the interest rate may increase upon closure of the qualifying personal checking account.

©2019 Visa U.S.A. Inc.

(in 7 minutes or less)

Banks With Free Checking Accounts With No Deposit Checking

Discover Checking Account

You might also be interested in:

- TD Debit Card AdvanceSM: a discretionary overdraft service

(Important Information about TD Debit Card Advance)