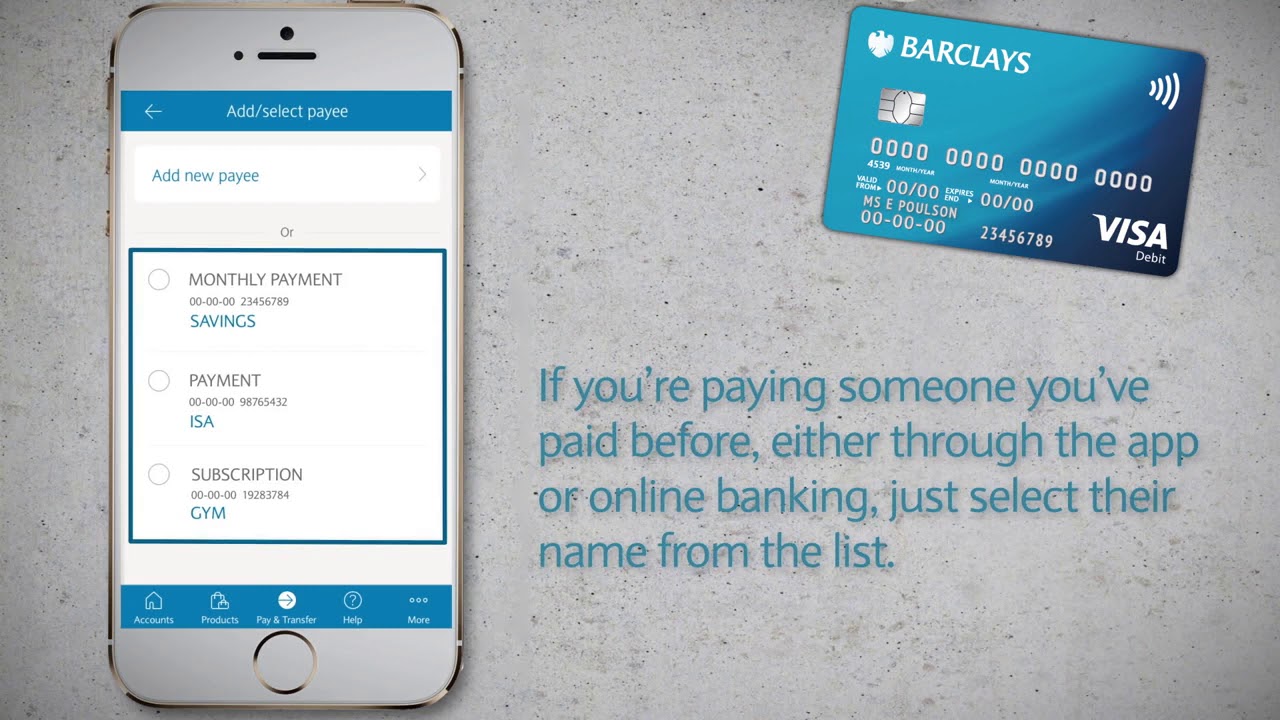

Barclays is leading the way in innovative, secure and efficient ways to make, collect and process payments. Through innovative mobile and electronic solutions, we’re committed to making payment simpler, faster and safer for you and your customers.

Solutions for your business

Pay In Cheque Barclays App

Access a range of domestic and international products and services, giving you the flexibility to meet your specific payment and collection needs. Our payments services include Bacs, CHAPS and Faster Payments.

Banks where you can pay in cheques with your phone. These are the only banks I can find which offer this feature. I found the feature in the “More” tab at the bottom of the app. There’s is a maximum cheque value of £500 and a daily limit of £1,000.

- Barclays is rolling out its mobile phone cheque service to another 1m customers, allowing them to pay in cheques by taking a photo on their smartphone rather than visiting a branch.

- Cheque Negotiation: lets you use the funds before the cheque has cleared and is credited to the account on the second working day. Cheque Collection: is a much slower service, where we wait for an answer from the bank upon which the cheque is drawn before crediting your account with the funds. This takes on average between four to seven weeks.

In 2018, UK banks introduced an image-based cheque clearing system, which aimed to make cheques a secure and convenient future payment method.

The new system meant that:

- Cheques can clear faster with funds being made available within two business days of the cheque being received (Monday to Friday, excluding bank holidays).

- If you issue a cheque, funds will leave your account faster.

Choose from a wide range of methods that can make initiating or receiving payments more efficient.

Is it right for you?

- You can make or take domestic or international payments through the service that most closely meets your business needs.

- You can choose from automated payments to paper-based payments, giving you flexibility.

How it works

- Through a range of UK and international payment services, you can send any amount to virtually anywhere in the world, electronically or by paper.

- Gives you peace of mind, with electronic and automated services providing a high level of security.

- Enables you to benefit from associated advantages, such as enhanced control or process efficiencies.

- Gives you access to our Cash Management specialists, who can work with you to tailor certain services to your needs.

Support all of your cash handling needs with our broad range of cash processing services. You can choose to deposit your cash at your local Barclays branch, or have it delivered to a central Barclays location using a Cash-in-Transit carrier company.

Is it right for you?

- You frequently receive large amounts of cash - but cannot hold it securely on your premises.

- You want to realise the value of your cash takings as soon as you can.

- You're looking for a secure method to deposit your cash.

How it supports your business

- Provides secure and convenient methods of depositing your cash and cheques.

- Gives you a range of delivery methods, including direct to cash centres, branch counters, in-branch self-service, and night safe devices.

- Provides enhanced security for depositing through bar-coded, self-seal, tamper-evident wallets.

- Can often be integrated with your existing security provider and processes.

Important information

If you use a night safe device, the contents will be processed on the following business day.

The products referred to in this section are subject to separate terms and conditions.

Use our extensive range of paper-based and electronic collections services to manage payments from customers.

Is it right for you?

- Your customers are looking for quicker and more convenient ways to pay you.

- You want to improve reconciliation and reduce administration.

- You want to give your customers flexibility in how they pay you.

- You want greater control over the ways in which you receive funds.

- You want to centralise your European Direct Debit collections.

How it supports your business

- Helps you control and predict cashflow by providing more payment collection certainty.

- Enables you to automate payment collection – including electronic regular payments using the Direct Debit service.

- Provides your customers with an easy, trusted Direct Debit payment method, protected by the Direct Debit Guarantee.

- Sterling and currency cheques can be deposited straight into your accounts.

- On transferring your business to Barclays, you can keep your Bacs third-party software.

Payment Acceptance

We provide a choice of end-to-end payment acceptance solutions that enable our clients to accept card payments face-to-face, online, by mail order or over the telephone.

Important information

The products referred to in this section are subject to separate terms and conditions. There are terms and conditions associated with becoming a Direct Debit Originator – please speak to your Relationship Team for more details.

Use our electronic forms below to make:

- Same-day payments using CHAPS

- Barclays International payments

- SEPA Credit Transfers (SCTs).

How to use the forms

Complete the appropriate form on screen, then print off and sign it. Please send your completed form to us using the directions provided.

Excel-format payment forms

PDF† guides to completing the payment templates

Editable PDF-format† payment forms

If you are unable to access the Excel-format payment forms, please use these editable PDF1 versions.

International Bank Account Numbers

Important information

Please note that all procedures relating to the completion and submission of the CHAPS and international payments remain unchanged.

As per Payment Services Regulations 2017, from 13 January 2018 any intra EU/EEA payments must be submitted with the SHA charging code. If you submit an intra EU/EEA payment with the OUR charge code we will convert this into SHA charge code.

We support payment service providers (PSPs) seeking to provide their own customers with services to transfer funds within the UK. We do so by providing PSPs with indirect access to the UK payment schemes. Barclays has subscribed to the voluntary Code of Conduct for Indirect Access Providers since 30 September 2015, including the current version which was published in November 20181.

You can choose from two types of indirect access:

Agency bank access

You are given your own sort code and can provide your customers with their own unique account number on that sort code.

This provides access to all UK clearing systems (see table below), allows you to appear as a UK clearing bank in your own right, and provides all the advantages of direct access without the high costs and operational requirements.

Eligibility: For agency bank access, you must be a payment services provider as laid down in the Payment Services Regulations 2017. Further eligibility criteria will include assessments for anti-money laundering, credit risk, procedural capability for scheme compliance and technical capability. Further details are available in this document (PDF 51KB)†.Non-agency access

You are given a settlement account in our books and typically identify your underlying beneficiary customer for payments by the reference in the payment instruction. This allows you to make and receive a variety of payments including Faster Payments, Bacs and CHAPS via Barclays.

Eligibility: Eligibility criteria for non-agency access will depend upon the precise services you require but will include assessments for anti-money laundering and credit risk. Further details are available in this document (PDF 51KB)†.Which UK payment systems can you access?

Agency Banks2 Electronic money institutions

Non-agency All3

1The Voluntary Code of Conduct for Indirect Access Providers (PDF 335KB)†

2 Access to payments via a sort code in the name of the Agency Bank

3 Access to payments via a Barclays account

What we can offer

We tailor our services and pricing to your individual requirements. The types of service we offer are shown on the following PDF:

Open the 'types of service' (PDF 711KB)†

What can payments and collections do for you?

Payments

Make UK or international payments efficiently through our payments products and services, offering a choice of delivery methods and timescales.

Collections

Barclays Pay In Cheque In Branch

Receive payments through our range of paper-based and electronic collections services. Benefit from the ability to better control and predict your cashflow.

Read the Cash Handling article (PDF 1.5MB)†

Important information

Barclays Pay In Cheque From Abroad

The products referred to in this webpage are subject to separate terms and conditions.

Read related insights

Can I pay a cheque into an account by mail?

Yes. If you wish to send a cheque into us via the post, please state the sort code and account number of the account you wish to credit on a covering letter or on the back of the cheque and send to.

Barclays

PO Box 9

Barclays House

Victoria Street

Douglas

IOM

IM99 1AJ

How helpful did you find this article?

Thank you for leaving some feedback

Thank you for taking the time to leave some feedback. We will use this information to improve our service.

Sorry this didn't answer your question

Please take a moment to leave some feedback, using the form below. PLEASE NOTE: Do not include any personal or account details: we cannot answer specific questions about your account.

Thank you for your rating

Please tell us why you found it useful using the form below. PLEASE NOTE: Do not include any personal or account details: we cannot answer specific questions about your account.