Stimulus payments and Chime

If you are a Chime member, you will be able to find out more about the status of stimulus payments on this page. We will be adding more details as we receive information regarding processing and payment timing.

Didn’t believe other posts about delayed deposits. Thought it was just a employer/payroll delay issue. For 3 years chime has always been on point. But chime is definitely fucking up. Have my check split in 2 accounts. Always have gotten chime deposit about 2 hours before other account. To deposit your IRS check (any government-related check like unemployment check or stimulus check), open Chime app Sign In to your account Tap on the Move Money option Then, choose Mobile Check Deposit option Tap on U.S Treasury Sign on the back of the check Write “For deposit to Chime only” under your signature Capture.

Please note that our member support agents do not have information on the status of Economic Impact Payments.

Updated Jan 11th, 2021

If you have not received a stimulus payment yet, you may be impacted by an IRS error.

The IRS recently announced that it will reissue payments for all those affected by Feb 1. Most members should receive payment via direct deposit, or in some cases, paper checks.

We will continue to make payments available as soon as they arrive and keep you updated.

We've got your back

We’re offering temporary access to $200 of spending power through SpotMe to a random selection of eligible Chime members before their stimulus payments arrive.

Direct deposit your stimulus with Chime›

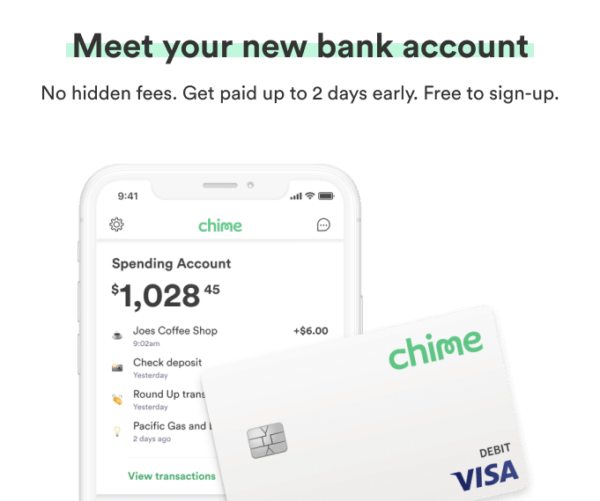

No hidden fees¹. Grow your savings automatically. Fee-free overdraft for eligible members².

Check my payment status›

Get information from the IRS on the status of your Economic Imapct Payment

We've got your back 💚

If you have questions regarding the stimulus payment and your Chime account, please check out our FAQ below.

If you’re eligible for an economic impact payment, but haven’t gotten it yet, it’s likely that the IRS will send you a paper check or debit card. This is expected to start soon and continue throughout the month of January.

If you received the previous stimulus payment as a direct deposit and haven’t received a second stimulus payment, the IRS likely routed your payment to tax preparer companies instead of your account. These payments were rejected and returned to the IRS. If you were impacted, you’ll either receive a paper check or a debit card from the IRS. If you do not receive your payment in any form, then you can claim the Recovery Rebate Credit on your 2020 tax return.

To check the status of your payment, go to IRS.gov/eip and use the Get My Payment tool.

For more information check out the IRS stimulus FAQs.

As with all direct deposits, Chime will make your money available the moment we can. Unfortunately, we have no way to track the status of your payment until it arrives in your account, but you may get your stimulus check early.

We’re offering temporary access to $200 of spending power through SpotMe to a random selection of eligible Chime members. The new SpotMe limit is temporary and limits will be adjusted to normal levels once stimulus payments are distributed.

Also, this increase cannot be combined with any offers or other bonuses. The maximum SpotMe limit is $200. Learn more here.

Is the increased SpotMe limit an advance, loan, and/or will this be in addition to what I receive with the government stimulus?

Your increased SpotMe limit is not an advance from Chime, a loan, or an addition to the government stimulus. It’s simply a step toward helping make the expected payment available to use as soon as possible.

What if someone offers to get me my stimulus payment sooner?

Protect yourself from scams. If someone is offering you a faster stimulus payment in exchange for money or information, they are a scammer. The IRS has noted a wave of new schemes involving Stimulus Payments. Most schemes involve attempts to collect your personal or financial information in order to receive your payment sooner, but other schemes may involve first sending you a bogus check and requiring that you call in with or mail in additional information.

If you are the target of a scam, you can report it to the IRS by emailing phishing@irs.gov. For more information, see the IRS’s Coronavirus scams page.

Learn how to perform a mobile check deposit at the many places that allow for such deposits.

First, we define what mobile check deposit or loading entails before outlining the specific steps on how to carry out the process.

You will also learn more about fake check deposits, fraud, and penalties for handling fake checks.

Contents

- How do mobile check deposits work?

- Mobile deposit fake check – Fraud & Penalties

- FAQ on Mobile Check Deposit

What is a mobile check deposit?

The mobile check deposit is a smart feature that enables people to easily and conveniently deposit their checks from their geographical locations.

You do not have to travel long distances to an ATM or bank branch to receive these services. However, for one to do that, he or she must have either a tablet or a smartphone with an app of their preferred bank.

How do mobile check deposits work?

The process of depositing your checks using this feature is as simple as taking a selfie using your phone.

A picture displays all the physical traits of a given object, and therefore, enabling the bank apps software to process the checks, once the images have been uploaded.

All you have to do is capture the back and front of your check. The picture of the check has to show both the front and back features for it to be processed effectively.

It is also one of the approaches to confirming that indeed the check is yours.

An individual may secretly take a picture of other people’s checks and upload only one side; so, if one side is acceptable, it will facilitate the theft of checks.

After you have uploaded the image of your check, you are expected to select the bank account where to deposit, enter the amount, and approve the details.

The amount entered has to match what is written on the check. For instance, if it is $3,000.00 on the check, the keyed-in figure must be $3,000.00.

Before, submitting the check for processing, you are required to confirm the details. Affirmation of the details assists in the elimination of the possible errors, which could delay the process of depositing your check.

It also removes the possibility of having the money deposited in the wrong bank account.

Lastly, after completing the above steps and have submitted the check, you will receive a notification informing you whether or not your check has been deposited.

If the check is rejected, you will be given a chance to review and repeat the steps above to deposit your check.

However, if the check is rejected completely, kindly contact the customer care of your bank for further details and assistance regarding their mobile check deposit services.

How does a mobile check deposit work at Bank of America?

For you to enjoy the banking services through your smartphone or tablet, you need to download the Bank of America app. You can get the app through this link here.

After downloading the app, you should install and register by opening the app. Once you have done that, you can deposit the check by taking the front and back of your check, enter the account and then tap ‘make a deposit.’

How does mobile check deposit work Wells Fargo?

As their customer, sign on to your Wells Fargo Mobile application, then upload the front and back of your check, enter the amount you want to deposit as written on the check, and submit for processing.

How does mobile cheque deposit work at RBC?

The RBC Mobile app is available at the App Store and Google Play, or one can send a text “RBC” to 722722 and the bank will send you the link.

Once you have the app, all you need to do is sign the front and the back of your check, take images, upload, and submit the correct detail for processing.

How does Chime’s mobile check deposit work?

The Chime application is available for Android and iPhone smartphone users. Once you have installed the app on your phone, you can deposit checks from any part of the world.

However, you must ensure the check pictures and details are correct and clear to prevent the cancellation of the check.

Chime Check Deposit Policy

How does the PNC mobile check deposit work?

At PNC, clients are allowed to deposit checks through their smartphones. The customer care team is always accessible to guide clients on how to do it.

However, the process is simple, as one is only required to send the picture of their correctly filled checks for processing.

How does Citibank’s mobile check deposit work?

Customers using the Citibank app are expected to only key in the details of their check as it appears in the images of their checks and submits them for processing.

The process takes less than 30 minutes before the check is fully processed and confirmed.

How does Fidelity mobile check deposit work?

On the Fidelity mobile app, you are required to tap the ‘deposit checks’ option and follow the steps to successfully deposit your check from your locality without having to visit the bank.

However, if the pictures of your uploaded checks are not clear, the process may be canceled.

Mobile deposit fake check – Fraud & Penalties

Counterfeit checks are usually rejected instantly after confirmation. Individuals can engage in these illegal activities by stealing checkbooks and making fake stamps.

In other instances, individuals can steal checks and attempt to deposit them through mobile apps, and giving false information, hoping the process will be successful.

Individuals who are found engaging in fake check businesses can be imprisoned or fined heavily, depending on the state laws of a particular country.

In other states, the suspects can both be fined and jailed when found guilty of dealing with fake checks.

I deposited a fake Check into my Account (or an ATM)!

Attempting to deposit a fake check into your ATM or account will raise integrity questions about your business and your account may be blacklisted or closed indefinitely until the investigation concerning the matter is complete.

Penalty for Depositing Fake Check

Individuals who are found engaging in fake check businesses can be imprisoned or fined heavily, depending on the state laws of a particular country.

In other states, the suspects can both be fined and jailed when found guilty of dealing with fake checks.

FAQ on Mobile Check Deposit

The following are the questions that are mostly asked across the various platforms about mobile check deposit

Chime Check Deposit Not Working

Can I deposit a Scanned check?

Yes, you can deposit such a check, but not all banks allow it. So, confirm with your bank by contacting them through their customer care service number.

How does remote deposit capture work?

The remote deposit allows you to snap or scan the image of your checks instead of moving the physical checks around. It happens through an encrypted internet connection to avoid the loss of sensitive information and checks.

Can you go to Jail for depositing a Fake Check?

Yes, you can be jailed as long as it is proven that you intentionally deposited the fake check. Therefore, you need to be careful when depositing checks.

References on Mobile Check Deposit

- 1: What is Mobile Check Deposit?

- 2: Mobile Banking App for iPhone and Android

- 3: What is Remote Deposit Capture?

Chime Bank Deposit Paper Check

READ: Mobile check deposit availability at Chase ATM