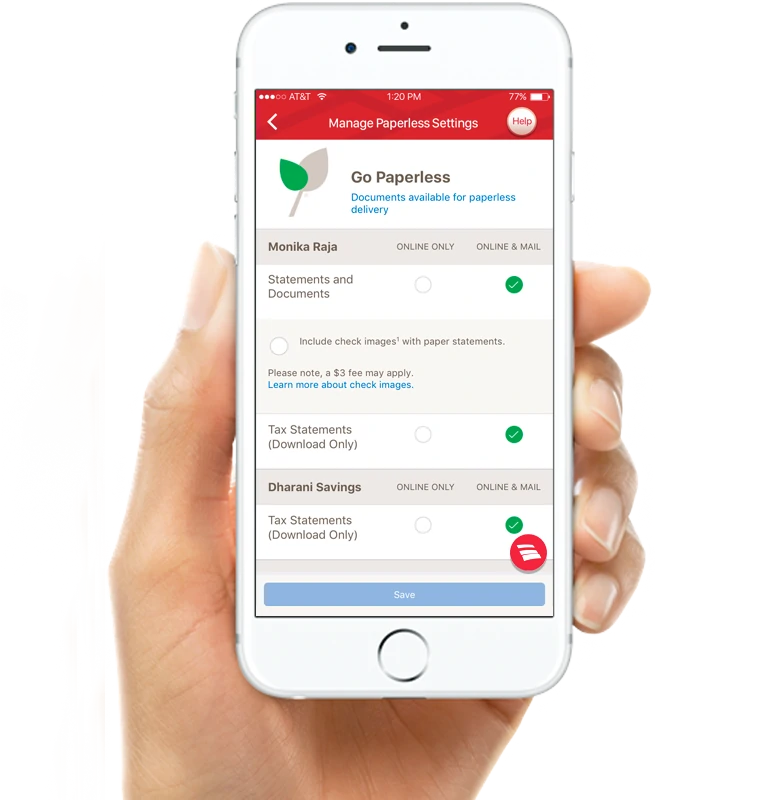

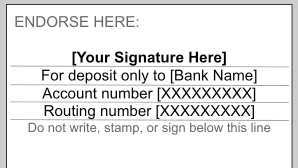

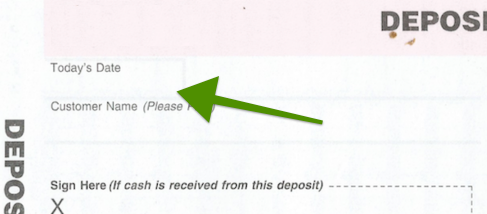

How to deposit checks with our Mobile Banking app. Open the app, use your fingerprint to securely sign in Footnote 3 and select Deposit Checks. Sign the back of the check and write “for deposit only at Bank of America”. Take photos of the front and back of the check with your smartphone — just select the Front of Check and Back of Check.

- Bank Of America Coin Policy

- Maximum Mobile Check Deposit Bank Of America

- Mobile Check Deposit Availability Bank Of America

Mobile Check Deposits are subject to verification and not available for immediate withdrawal. Other restrictions apply. In the Mobile Banking app menu, select Deposit Checks, then Help for details and other terms and conditions. Message and data rates may apply. Mobile Check Deposit will only accept standard-sized personal or business checks. Bank of America also has 'cardless ATMs,' meaning you can use your phone to order a withdrawal in advance of an ATM visit. You choose your checking or savings account int he mobile app, choose 'Start ATM Withdrawal,' choose an amount to withdraw, and then you'll be able to pick it up at the ATM by simply entering using your phone's digital wallet or your debit card. Mobile check deposit provides you a secure and convenient option right from your home! Important Information: Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (BofA Corp.).

1To send or receive money with a small business, a consumer must be enrolled with Zelle with a linked domestic deposit account at a U.S. financial institution that offers Zelle. Small businesses are not able to enroll in the Zelle app, and cannot send or receive payments from consumers enrolled in the Zelle app.↩

2Zelle should only be used to send money to friends, family or others you trust. We recommend that you do not use Zelle to send money to those you do not know. Transfers require enrollment in the service and must be made from an eligible Bank of America consumer or business deposit account to a domestic bank account or consumer debit card. Recipients have 14 days to enroll to receive money or the transfer will be canceled. Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle. We will send you an email alert with transaction details after you send money using Zelle. Dollar and frequency limits apply. See the Online Banking Service Agreement at bankofamerica.com/serviceagreement for further details. Data connection required. Message and data rates may apply. Neither Bank of America nor Zelle offers a protection program for any authorized payments made with Zelle. Regular account fees apply. Payments made between consumers enrolled with Zelle do not typically incur transaction fees.↩

Bank Of America Coin Policy

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC, and are used herein under license.

Maximum Mobile Check Deposit Bank Of America

Mobile Check Deposit Availability Bank Of America

3Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.↩

4To receive money from a small business, a vendor must be enrolled with Zelle with a linked domestic deposit account at a U.S. financial institution that offers Zelle.↩

Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation.