Features & Benefits of SBI Fixed Deposit 1. Competitive rate of interest - Investors in SBI fixed deposits can get up to 5.40% rate of interest on their deposits. In case of senior citizens, the interest rate goes. Scheme Name Processing Fees Max Processing Fees Min Processing Fees; SBI CAR LOAN(For New Vehicle) 0.40% of Loan Amount + GST: Rs 7500/ + GST: Rs. Monthly Interest Payment. SBI Jumbo Junior Instant Access Savings Account - Issue 2. Gross rate (monthly interest. Before the deduction of income tax). For example, the current repo rate is at 6%. Hence, the current SBI Savings Account Interest Rate for the money which is beyond Rs.1 lakh will be arrived as below. SBI Savings Account Interest Rate (For above Rs.1 Lakh Balance)=Repo Rate.

SBI Personal Loan Interest Rates - Updated as on 07 March 2021

SBI Personal loan Interest Rates under various categories & different schemes as follows:

| SBI Xpress Bandhan Loan | Xpress Credit Personal Loan | SBI Pension Loan |

| 12.15% - 15.15% | 11.65% - 14.65% | 11.60% |

| Xpress Credit Loan (IT Employees) | SBI Salary Package Ac holders | Non-Permanent Employees (NPEs) |

| 13.05% - 15.05% | 10.65% - 12.15% | 12.55% - 14.90% |

| Jai Jawan Pension Loan | Pension loans to Coal Mines PF | Clean Overdraft Loan |

| 11.60% | 11.60% | 16.70% |

| OD for E-commerce purchases | Loan against shares | Loan against NSC / KVP |

| 13.75% | 10.65% | 12.80% |

Get gifts upto ₹ 18,490 on disbursal.

Get gifts upto ₹ 18,490 on disbursal. Refer to T&C - www.deal4loans.com/personal-loan-offers.php

List of Documents required of SBI Personal Loan

Salaried (Salaried Class)| Eligibility | Loan Amount | Documents Required |

| Resident of India | Minimum - Rs 24,000 in metro and urban centres and Rs 10,000 in rural/semi-urban centres Maximum: 12 times net monthly imcome (salaried and pensioners) |

|

हिंदी में जानकारी के लिए, यहाँ SBI पर्सनल लोन हिंदी में पढ़ें

SBI Personal Loan EMI Calculator

To figure out how much emi for the loan amount you have to pay for; you can use this emi calculator tool. For calculate you can just enter your loan amount, interest rate & tenure repayment period.

For Example: assume you taken a loan amount of Rs.2 lakh for various years @ different rate of interest than your loan calculations are as below:

| Loan Amount | ROI | Tenure(years) | Monthly EMI | Total Interest |

| 2,00,000 | 12.45% | 3 | ₹ 6686 | ₹ 40693 |

| 2,00,000 | 14.95% | 4 | ₹ 5561 | ₹ 66932 |

| 2,00,000 | 16.55% | 4 | ₹ 5725 | ₹ 74778 |

Available Personal Loan Types of State Bank of India

SBI Xpress Credit Personal Loan

SBI offers loan upto 24 times of net monthly income for salaried class individuals and pensioners. The maximum limit for personal loan is Rs. 15 lakh.- Minimum EMI per lakh Rs. 2,616 - Rs. 2,765 for 4 years.

- Interest Rates - 11.65% - 14.65% p.a

- Security - NIL

- Processing Fees - SBI charges 1% of loan amount + applicable taxes

- Part payment charges - 6 months to 60 months (or residual service period whichever is lesser)

- Minimum salary of Rs.7,500

SBI Xpress Credit Personal Loan Eligibility

SBI provides Xpress Credit personal loan to the employees of under noted entities maintaining salary account with zero margin:

SBI provides Xpress Credit personal loan to the employees of under noted entities maintaining salary account with zero margin:- Central and State Government

- Quasi-Government

- Central PSUs

- Profit making State PSUs

- Education Institutions of National Repute

- Selected Corporates

- 24,000 for term loan

- 10 lakhs for overdraft

SBI offers loan upto 24 times of net monthly income for salaried class individuals and pensioners. The maximum limit for personal loan is Rs.15 lakh.

SBI Pension Loan

Interest Rates on SBI Pension Loan - 11.60% p.a.Features & Benefits of SBI Pension Loan:- Low processing fee, no hidden charge, no pre-payment charges

- Family pensioner (spouse authorised to receive pension after pensioner's death) can avail loan but the applicant should not be more than 76 years.

- Maximum 50% amount of pension is considered for availing loan.

- SBI charges processing fee of 0.51% of the amount (+applicable taxes) with minimum Rs 500/-). Processing fee is not charged from SBI Defence Pensioners.

- Minimum loan amount is Rs 25,000

- Maximum loan amount Rs 14 lakh for applicants below 72 years

- Maximum of Rs 12 lakh for pensioners who are between 72 and 74 years

- Maximum amount of Rs 7.5 lakh for applicants between 74 and 76 years

- For family pensioners, minimum loan that can be availed is Rs 25,000.

- Minimum loan amount is Rs 25,000

- Rs 14 lakh for applicants upto 72 years of age

- Rs 12 lakh for pensioners between 72 and 74 years

- Rs 7.5 lakh for applicants between 74 and 76 years (EMI / NMP not to exceed 50% in all the cases for Family Pensioners)

- Minimum amont Rs.25,000

- Rs.5 lakh for pensioners upto 72 years of age

- Rs.4.5 Lakh for pensioners between 72 and 74 years

- Rs.2.5 Lakh for pensioners between 74 and 76 years (EMI / NMP not to exceed 33% in all the cases for Family Pensioners)

Processing Fees: For Central & State Government Pensioners (including Family Pensioners) - 0.50% of the Loan Amount + applicable tax subject to Minimum of Rs. 500

For Defence Pensioners – NIL

SBI Saral Personal Loan

Saral personal loan is available for any legitimate purpose to those working in corporate sector, self-employed, engineers, doctors, architects, chartered accountants, MBA with two years of employment.

SBI Saral Personal Loan Eligibility You are eligible for SBI Saral Personal Loan if you are:- Salaried and working with any leading corporate house

- Self-employed (engineer, doctor, architect, chartered accountant, MBA) with minimum 2 years' experience.

- Rs.24,000 in metro and urban centres

- Rs.10,000 in rural/semi-urban centres

SBI offers loan upto 12 times of net monthly income for salaried class individuals and pensioners. The maximum limit for personal loan is Rs.10 lakh.

Security - NIL

Processing Fees - SBI charges 2% - 3% of loan amount + applicable service tax

Repayment Period - 48 EMIs

SBI Personal Loan Customer Care Number Toll Free Number

If customers / borrowers have any queries/complaints/issues related to personal loan from State Bank of India, They can talk to a customer care executive at below mentioned toll free numbers.- 1800-11-2211

- 1800-425-3800

Compare SBI Personal loan Interest Rates with other banks in India

| Bank | Interest Rates |

| ICICI Bank | 10.99 – 16.50% |

| Kotak Mahindra | 10.50 - 17.25% |

| Standard Chartered | 11.50 - 18.00% |

| HDFC Bank | 10.75 - 20.75% |

| Bajaj Finserv | 11.99% onwards |

| IndusInd Bank | 11.25% onwards |

| Citibank | 10.99% |

| Tata Capital | 11.25% - 19% |

| Fullerton India | 11.99 - 26.00% |

Check SBI Personal Loan Status of Application / Loan Query

You can check your personal loan status in State bank of India, via these methods which are mentioned or illustrated here: check your SBI Personal Loan application status hereAbout State Bank of India

SBI is the largest lender in the country and has its headquarters in Mumbai, Maharashtra. The majority is owned by the Government of India. SBI is ranked as 236th in the Fortune Global 500 list of the world's biggest corporations of 2019.

It is the largest bank in India with a 23% market share in assets, besides a share of one-fourth of the total loan and deposits market. Highest Bank branches with 22,010 locations. Revenue ₹2.79644 trillion (US$39 billion) (2019). Number of employees at present working in SBI are 257,252 (March 2019). 'Best Transaction Bank & Best Payment Bank in India' Award for 2019.

State Bank of India Head Office Address:

State Bank of India, State Bank Bhawna, 16th Floor, Madame Cama Road, Mumbai-400021

Other Products of State Bank of India:

✓ SBI Home Loan✓ SBI Credit Card

✓ SBI Car Loan

✓ SBI Business Loan

✓ SBI Property Loan

✓ SBI Two Wheeler Loan

✓ SBI Two Wheeler Loan✓ SBI Education Loan

✓ SBI Fixed Deposit Rates

Want to earn safe returns on your investments? Then, look to invest in a fixed deposit that offers fixed returns over time. But the big question is, where should you open a fixed deposit? The question assumes significance given there are many banks and non-banking finance companies (NBFCs) waiting to make you a customer. But the largest public sector bank State Bank of India (SBI) has a distinctive advantage over others. The reason being the attractive interest rates as well as the massive PAN India presence with around 25,000 branches across the country. It won’t be wrong to say that SBI fixed deposit is a symbol of trust. Catch more of it in this page.

Table of Contents

- 2 SBI Fixed Deposit Interest Rates and Other Details

- 4 How To Apply for State Bank of India Fixed Deposit?

- 5 SBI Fixed Deposit Form

- 5.1 A Look at SBI’s Branch Network

Sbi Interest Rates 2019

SBI Fixed Deposit Schemes

The bank offers several fixed deposit plans to cater the diverse financial needs of the customers. It provides deposits for tenures ranging from 7 days to 10 years at varied interest rates. You can open a fixed deposit account with the lowest amount of INR 1,000. Interestingly, the 5-year tax saver fixed deposit of SBI doesn’t come with the maximum limit on deposits. You have the option to select the investment period and the amount of investment as per your financial goals. Depositors can receive interest at the payout frequency decided by them.

SBI Fixed Deposit Interest Rates and Other Details

| Fixed Deposit Aspects | Details |

|---|---|

| Minimum Deposit Amount | INR 1,000 |

| Maximum Deposit Amount | No Limit |

| Rate of Interest | 2.90% - 6.20% per annum |

| Tenure | 7 days to 10 years |

| Loan Facility | Upto 90% of the Principal Deposit |

| Premature Withdrawal Facility | Available |

| Interest Payout Frequency | Monthly/ Quarterly/ Half Yearly/ Yearly |

SBI Fixed Deposit Interest Rates March 2021

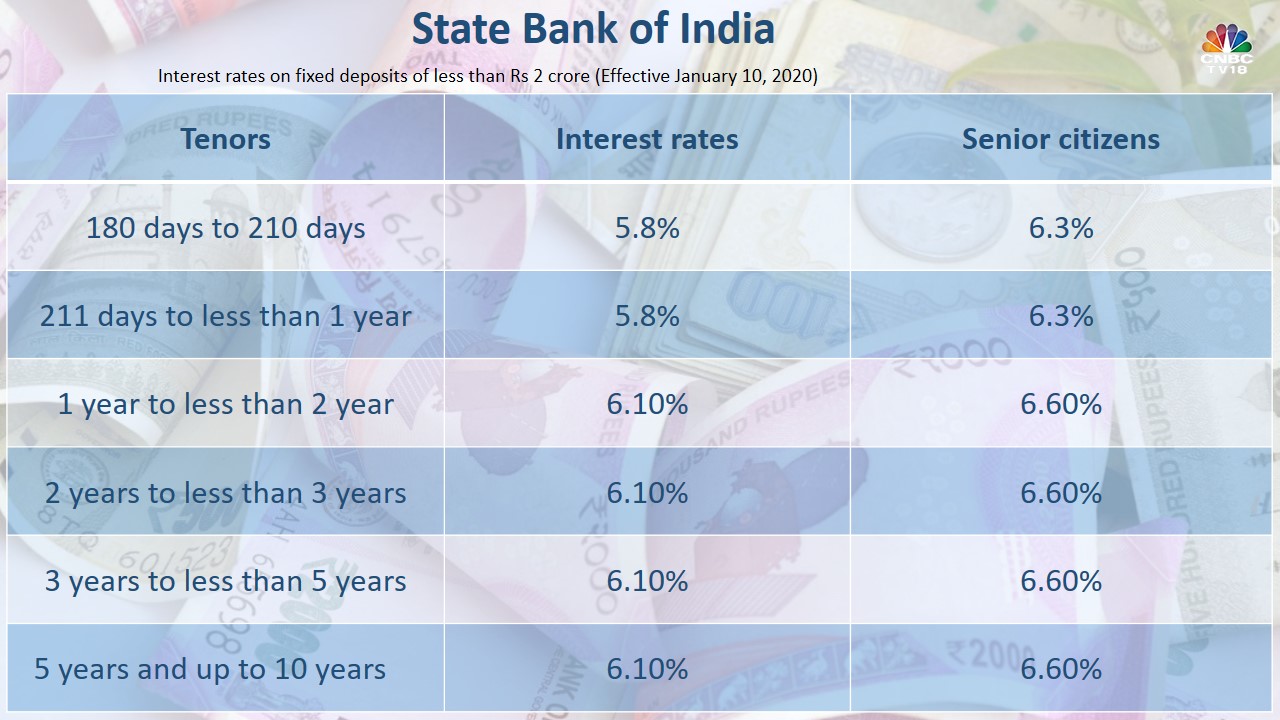

SBI Fixed Deposit Interest Rates generally range from 2.90% - 6.20% per annum which is quite high seeing the current market standards. The bank pays an additional interest to senior citizens. To know the FD interest rate of different investment periods, check the interest rate table given below:

Interest Rates on Retail Deposits Below INR 2 Crore

| Deposit Periods | Interest Rates for General Public (in per annum) | Interest Rates for Senior Citizens (in per annum) |

|---|---|---|

| 7 - 45 Days | 2.90% | 3.40% |

| 46 - 179 Days | 3.90% | 4.40% |

| 180 - 210 Days | 4.40% | 4.90% |

| 211 Days - Less Than 1 Year | 4.40% | 4.90% |

| 1 Year - Less Than 2 Years | 5.10% | 5.60% |

| 2 Years - Less Than 3 Years | 5.10% | 5.60% |

| 3 Years - Less Than 5 Years | 5.30% | 5.80% |

| 5 Years - 10 Years | 5.40% | 6.20% |

Interest Rates on Retail Deposits of INR 2 Crore and Above

| Deposit Periods | Interest Rates for General Public (in per annum) | Interest Rates for Senior Citizens (in per annum) |

|---|---|---|

| 7 - 45 Days | 2.90% | 3.40% |

| 46 - 179 Days | 2.90% | 3.40% |

| 180 - 210 Days | 2.90% | 3.40% |

| 211 Days - Less Than 1 Year | 2.90% | 3.40% |

| 1 Year - Less Than 2 Years | 2.90% | 3.40% |

| 2 Years - Less Than 3 Years | 3.00% | 3.50% |

| 3 Years - Less Than 5 Years | 3.00% | 3.50% |

| 5 Years - 10 Years | 3.00% | 3.50% |

SBI Fixed Deposit Calculator

The SBI Fixed deposit calculator is the tool which gives an exact idea about the amount of interest that you can get on the principal amount deposited under the scheme. Using it they can calculate the total amount they are likely to receive after the maturity of the fixed deposit. They can even reinvest the interest amount to yield more interest at maturity.

How To Apply for State Bank of India Fixed Deposit?

To apply for a fixed deposit at SBI, the candidate needs to fill the application form by visiting the nearest bank branch. Other way is to download the application form from the bank’s official website and submit it along with the requisite documents at the branch office. Candidates can even open the FD account online from the comfort of your home/office and save your precious time. You must have the following to apply online.

- Savings Account with SBI

- Internet banking username and password

- At least one transaction account should be mapped to the username

Steps To Apply Online

- Log in to the Online SBI account.

- Enter the username and password

- Click on the Login button

- Once the savings account is visible, click on the e- Fixed Deposit link provided on the menu.

- On clicking, the page will open where the depositor can create various deposits online.

- From the left-hand side menu, select the e-TDR/STDR option.

- Now feed the savings account number that is to be debited. Enter the amount and select the TDR or STDR option.

- Click on the confirmation button. Now, the online fixed deposit account is generated.

Sbi Interest Rates 2020

SBI Fixed Deposit Form

The SBI fixed deposit form is available online as well as at branch offices. In order to avail the benefits of fixed deposits, you need to fill the following details in the form:

- Customer status – existing customers or new to the bank

- Applicant’s details

- Co-applicant’s details

- Funding account details i.e., the account to be debited

- Term of deposit

- Product name or the name of deposit scheme

- Frequency of interest payable

- Details of account in which interest is to be credited

- Maturity instructions (tenure of policy, auto-renewal)

- Signature of both the customers

Sbi Interest Rates Latest

A Look at SBI’s Branch Network

Sbi Interest Rates Nri

SBI is an Indian multinational, public sector banking and the financial company which has its headquarters in Mumbai. It is one of the most trustworthy bank in the country. It has a wide network of 14,000 branches spread across the country.